Turning Bitcoin into a Gift Card in 2025: A Clear, Real-World Guide

Bitcoin is now one of the fastest ways to buy a digital gift card. This guide shows how BTC payments work, why users prefer them and how ACEB.com delivers instantly.

Turning Bitcoin into a Gift Card in 2025: A Clear, Real-World Guide

Bitcoin has been called many things over the years: an experiment, a revolution, digital gold, a hedge, a speculative asset, a freedom tool, a generational technology. What it has rarely been called is practical. For most of its life, Bitcoin was something you held, not something you used. People didn’t spend it on everyday things because the tools were clunky, the ecosystem immature, and the idea of converting BTC into real-world value felt complicated.

But 2025 looks nothing like the world in which Bitcoin was born. The infrastructure has matured, the wallets have improved, confirmation times feel predictable, and the global nature of BTC payments aligns perfectly with how digital life works today. People increasingly want ways to convert a portion of their Bitcoin into something instantly usable — gaming credit, shopping balance, entertainment value, or subscriptions — without cashing out to a bank or dealing with card restrictions.

One solution has quietly become the bridge between Bitcoin and everyday spending: digital gift cards. Not as a workaround, not as a gimmick, but as a simple, globally functional way to turn BTC into something actionable with no bank involved. This guide takes a deep, editorial look at how and why Bitcoin is now one of the cleanest ways to buy a digital gift card, and how the checkout flow on ACEB.com makes the process predictable and frictionless.

1. Bitcoin in 2025: from ideology to infrastructure

The story of Bitcoin is inseparable from the story of the internet’s evolution. In its early era, BTC was treated like a political or technological experiment: mined on laptops, traded on obscure forums, manually stored in text files, with no mobile wallets or mainstream places to use it. But over the years, Bitcoin stopped being an idea and became a system — a global settlement network running nonstop for more than a decade without a central operator.

By 2025, Bitcoin’s role is defined by three characteristics:

1. Predictability: A fixed supply of 21 million coins, halving cycles that act like economic heartbeat pulses, and consensus rules that haven’t changed dramatically in over a decade. People trust Bitcoin not because it’s exciting, but because it’s stable in structure.

2. Liquidity: Bitcoin is held everywhere — hardware wallets, custody solutions, mobile apps, exchanges, lightning wallets. Everyone from long-term holders to digital nomads can send BTC at almost any hour from almost any device.

3. Global neutrality: It doesn’t care where you’re from, what your bank supports, or whether you’re traveling. It behaves the same in Tokyo, Berlin, Lagos or São Paulo. That makes Bitcoin especially powerful for digital goods that don’t need shipping, logistics or physical presence.

Gift cards sit exactly at the intersection of these strengths: instant, borderless, digital, and universally redeemable. And because Bitcoin transactions can be executed from nearly any wallet, the bridge between BTC and digital credit feels more seamless than ever.

2. Why people convert Bitcoin into digital gift cards

If you ask ten Bitcoin users in 2025 why they occasionally spend BTC on gift cards, you’ll hear ten different stories — but all pointing to the same underlying trend: people want digital value that works everywhere without banking friction.

Some users accumulate BTC through mining or DCA strategies and periodically want to convert a small portion into practical spending. Others work in online industries where Bitcoin payments are common, and they need a way to turn that value into personal or household purchases. Travelers rely on BTC to bypass card restrictions or currency issues. And a growing segment of users simply prefer not to expose their bank cards to foreign websites.

Digital gift cards solve all of this naturally:

Instant usefulness: The moment you receive a code, you can top up a gaming platform, renew Netflix, buy books, rent a movie, order essentials or send someone a gift.

Zero dependence on banking systems: If your card fails, if you’re traveling, if you’re buying from a region-specific retailer — Bitcoin doesn’t care.

Easy for non-crypto recipients: Sending someone BTC requires them to understand wallets, addresses and confirmations. Sending them a digital gift card requires nothing more than email.

A private, direct way to spend: For some users, paying with Bitcoin eliminates the feeling of exposing financial data on every platform.

It’s this combination of flexibility, neutrality and speed that makes Bitcoin a surprisingly natural payment method for digital gift cards in 2025.

3. What people actually buy with Bitcoin (real trends)

Unlike the early 2010s, where BTC spending was mostly experimental, today it is anchored in well-established digital behaviors. A quick look at user patterns shows that BTC spending concentrates around several core areas of digital life.

Entertainment ecosystems

Streaming platforms, apps and digital subscriptions remain some of the most common use cases. People use BTC to renew accounts that otherwise require regional cards or recurring billing arrangements they prefer to avoid. Platforms such as Netflix, Spotify or YouTube Premium fit perfectly into the “instant value” model of gift cards.

Gaming and in-game value

Gaming is one of the largest digital economies in the world. BTC users frequently top up gaming balances late at night, during releases, or when traveling. Buying credit for ecosystems like Steam, PlayStation or Xbox becomes frictionless when the payment is crypto-based and the delivery instantaneous.

Retail purchases through universal credit

One of the smoothest ways to convert Bitcoin into actionable purchasing power is by using retailers with broad catalogs. For example, the Walmart USA gift card allows BTC holders to instantly transform part of their Bitcoin into shopping balance that covers everything from electronics and groceries to everyday essentials. It’s a clean bridge between digital value and real-world utility.

Another category that aligns naturally with Bitcoin payments is apparel and lifestyle retail — a sector where users prefer one-time top-ups instead of exposing bank cards to multiple online stores. Brands with strong digital ecosystems, like Nike USA gift cards, remain popular for exactly this reason.

Across all categories, the pattern is the same: Bitcoin transforms into value without touching a bank or waiting for a withdrawal. This is especially relevant in the broader shopping and retail category, where users appreciate both the convenience and the ability to manage spending directly through digital balance.

4. How Bitcoin payments work behind the scenes

Bitcoin payments appear simple to the user — scan the QR code, send the amount, receive the code. But under the surface lies a highly structured and reliable process that makes the entire experience feel predictable.

When you choose Bitcoin at checkout, the payment processor creates a Bitcoin invoice. This invoice contains several elements:

• a unique receiving address;

• an exact BTC amount calculated from current exchange rates;

• a QR code for convenience;

• a countdown timer locking in the price temporarily;

• an internal mechanism that monitors the transaction in the mempool.

Once the user sends BTC, the processor listens for incoming transactions. Depending on the wallet used, the processor may detect the transaction almost instantly at the network broadcast level — well before final confirmation. However, final settlement happens only after the blockchain confirms the transaction within the required number of blocks.

After the processor considers the invoice paid, the delivery trigger is immediate. That’s why platforms like ACEB can provide true instant delivery: they automate fulfillment the moment the processor approves the payment, with no manual review or intervention.

5. The Bitcoin checkout experience on ACEB.com

Although the mechanics of Bitcoin are universal, the user experience varies dramatically between platforms. ACEB follows a clean, minimalistic flow designed for people who value speed and clarity over friction.

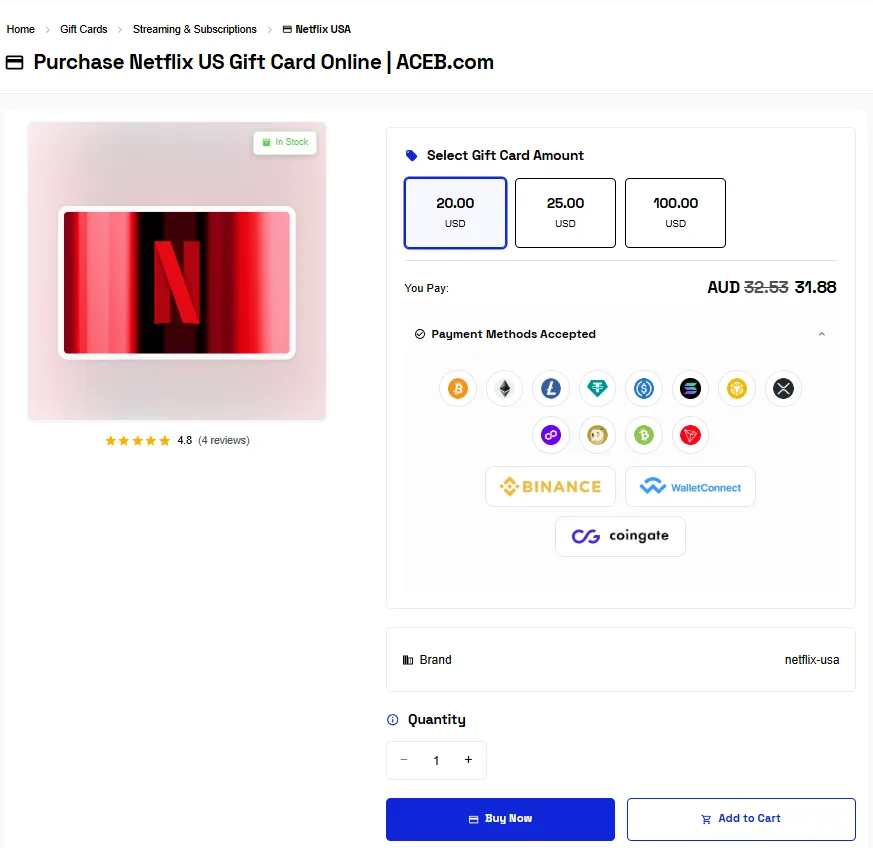

Step 1: Choose your product

Every gift card on ACEB is region-specific. Users select the correct region (e.g., Steam Italy), choose the denomination and proceed. The product pages are stripped to essentials: region, amount, description and delivery details.

Step 2: Add to Cart or Buy Now

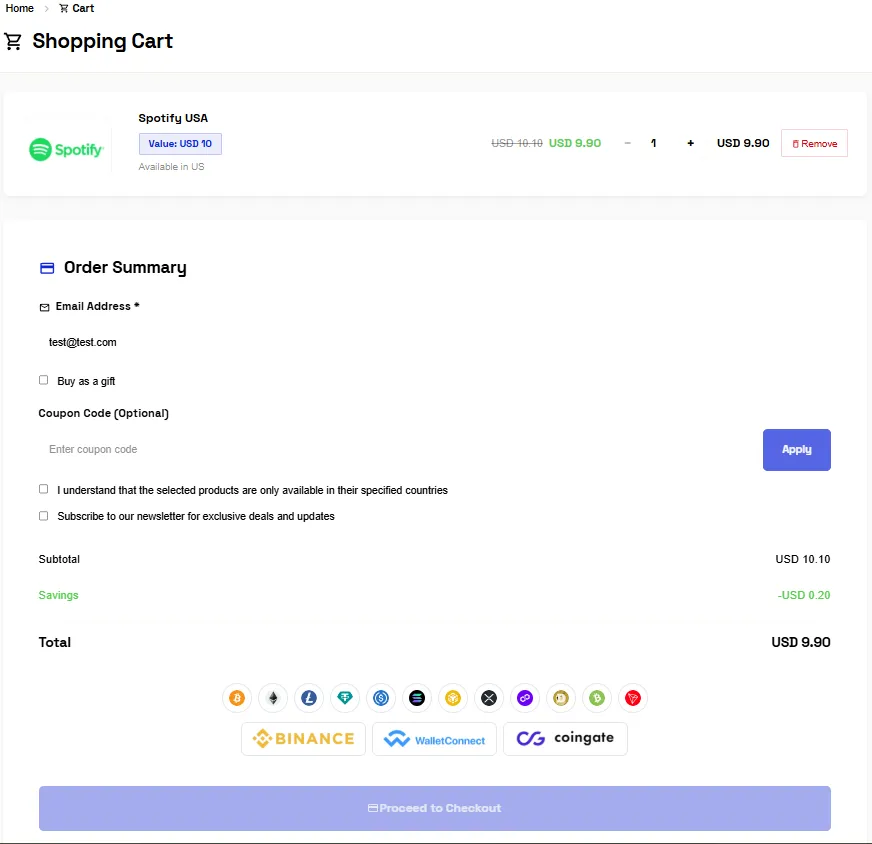

BTC users often prefer one-item purchases, but the cart supports multiple products if needed.

Step 3: Enter your email

On ACEB, you don’t create an account. You only enter your email, which is the destination for your digital code. This simplifies the process for users who prefer anonymity or minimal data sharing.

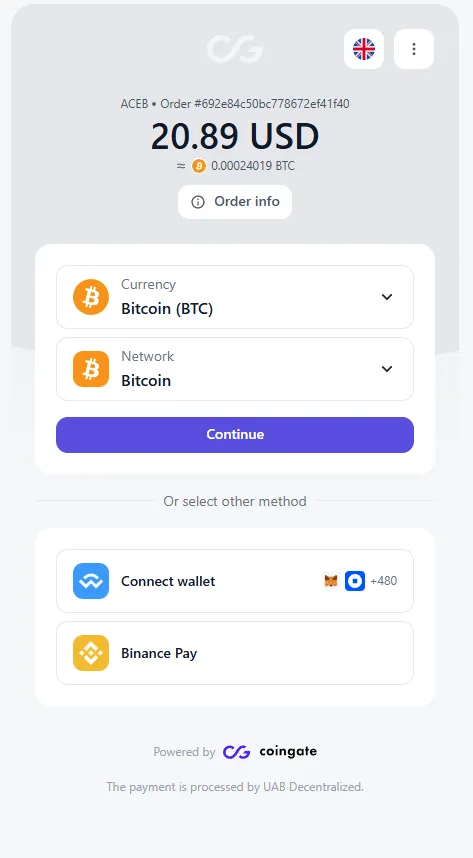

Step 4: Redirect to the Bitcoin invoice

Once you proceed, ACEB redirects you to the payment processor’s Bitcoin invoice page. Here you select BTC if needed (some processors auto-select it), and the invoice shows:

- exact BTC amount;

- receiving address;

- QR code;

- timer window;

- live payment status indicators.

Step 5: Pay the invoice

From your wallet — whether hardware, mobile or exchange-based — you send the precise BTC amount. Any deviation (overpay or underpay) may invalidate the invoice.

Step 6: BTC confirmation

The Bitcoin network confirms your transaction. Depending on congestion, confirmation can take a few minutes or slightly longer. The processor updates the status in real time.

Step 7: Instant code delivery

The moment the processor marks your payment as paid, ACEB instantly delivers the code to your email. There are no manual approvals or waiting periods. The automation ensures the delivery speed depends solely on the blockchain’s confirmation time.

6. Common mistakes when paying with Bitcoin (and how to avoid them)

While Bitcoin payments are highly reliable, a few mistakes occur repeatedly — usually due to user misunderstanding rather than technology issues.

Sending the wrong amount

Bitcoin invoices are precise. Sending slightly more or less often leads to an invalid payment. Always use your wallet’s exact-send feature when available.

Transaction delays from certain exchanges

Some exchanges batch withdrawals or delay broadcasts, which can cause transactions to miss the invoice timer. Paying from a personal wallet is always more predictable.

Ignoring confirmation times

In periods of high blockchain activity, confirmation may take longer. This isn’t a platform issue — it’s the natural functioning of Bitcoin’s fee markets.

Not scanning the QR code

Manual copy-paste leads to errors in address or amount. QR codes eliminate these risks entirely.

7. How Bitcoin spending culture has evolved

Bitcoin users in 2025 fall into two broad categories: holders who treat BTC as long-term savings, and spenders who use it as a fluid digital currency. But many users are actually both — they hold most of their BTC and occasionally convert a small portion into something immediately useful.

This hybrid behavior reflects a more mature understanding of Bitcoin. Instead of viewing spending as incompatible with holding, users see gift cards as a logical extension of Bitcoin’s utility. They preserve long-term upside while allowing small amounts of BTC to fund personal consumption, travel, entertainment or everyday needs.

Another cultural factor: Bitcoiners value autonomy. Converting BTC into digital credit without relying on banks, cards, geo-restrictions or KYC-heavy processes aligns with this ethos. It feels consistent with the philosophy of Bitcoin itself.

And for users who prefer Ethereum or simply want more options, ACEB also provides a full guide on how to buy a digital gift card using ETH, offering a different perspective on crypto-native spending.

8. Editorial insights: Bitcoin as a spending asset

In a world of increasingly digital-first consumption, Bitcoin’s role as a spending tool has become clearer. Traditional card systems are reliable but geographically constrained. Bank transfers are slow. Fiat withdrawals involve compliance checks, settlement times and delays. Bitcoin bypasses all of this with a direct path from wallet to product.

Gift cards extend this logic even further, offering immediate access to digital products or online purchases without waiting for funds to arrive in a bank account. Platforms like ACEB act as the final puzzle piece — providing instant codes, global availability and a frictionless checkout flow.

Conclusion: Bitcoin → real value, without compromise

Using Bitcoin to buy digital gift cards in 2025 is no longer a workaround — it’s one of the simplest and cleanest ways to turn digital currency into everyday value. The BTC → invoice → confirmation → instant delivery flow has matured into a reliable, predictable experience.

If you want speed, global accessibility and a checkout system designed for crypto-native users, ACEB.com offers one of the most straightforward Bitcoin purchasing experiences available today. From retail and entertainment to gaming ecosystems and daily digital life, Bitcoin has finally become more than a store of value — it has become a spending tool that fits the rhythm of modern digital consumption.

External reference: bitcoin.org